TransCanna Cannabis Stock Up 11.16 Percent For Week of March 30, 2019

A primary driver for this Canadian marijuana stock (CSE: $TCAN) during the week of March 30 was an announcement by the accounting firm Green Growth CPA. Green Growth concluded Transcanna Holdings had a “valuation range of $50 million to $75 million (U.S.), as of January 31, 2019.

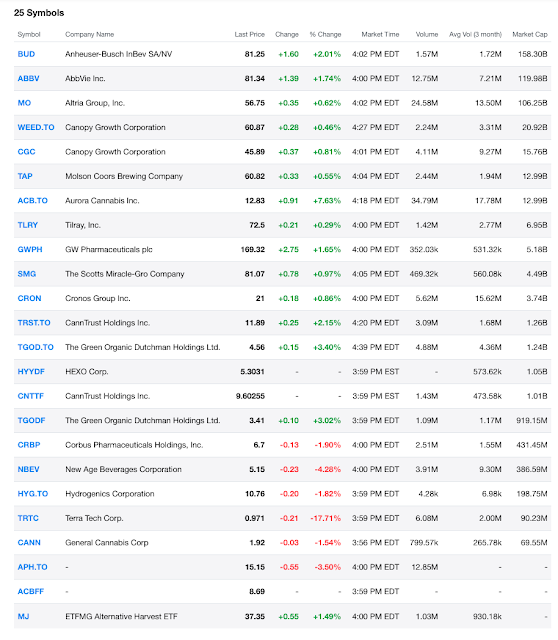

Meanwhile, investors in the burgeoning marijuana stock sector received some great news last week when the House Financial Services Committee passed a cannabis-banking bill. The Safe Banking Act was passed by a vote of 45 to 15 and now faces a full House vote. With 152 co-sponsors already signed on in support of the legislation, there is hope the SAFE Banking Act will finally provide America’s financial institutions the right to work with the legal marijuana industry.

Other big stories this week for marijuana stocks involved adult-use legalization in Guam, the Mexican government asking its citizens if marijuana should be legal, and the head of the Food and Drug Administration (FDA) clarifying the agencies enforcement priorities for CBD products.

But while America’s interest in legalizing recreational marijuana hit a new high last week, the potential use of the plant’s CBD cannabinoid (Cannabidiol) for medicinal applications (now available at Walgreens and CVS) had many investors intrigued.

As for Transcanna's stock value, in addition to receiving a multi-million dollar valuation from GreenGrowth CPA last week, the Winslow Record reported that Transcanna currently has a debt to equity ratio of zero.

According to Winslow, "this ratio provides insight as to how high the firm’s total debt is compared to its free cash flow generated. In terms of Net Debt to EBIT, that ratio stands at 0.03705. This ratio reveals how easily a company is able to pay interest and capital on its net outstanding debt. The lower the ratio the better as that indicates that the company is able to meet its interest and capital payments. Lastly we’ll take note of the Net Debt to Market Value ratio. TransCanna Holdings Inc.’s ND to MV current stands at -0.001091. This ratio is calculated as follows: Net debt (Total debt minus Cash ) / Market value of the company."